As the business globalisation market is getting bigger and competitive nowadays, there is getting more Singapore businesses tends to venture into international market in Southeast Asia for expanding their business and gains higher sustainable competitive advantages. While, it is important that to understand how the tax system running in target market country, as it could having some differences and complexities on their tax-compliance obligation. It could be getting worse and caused of losses especially when tax penalties incurred due to non-compliance. Therefore, the following contents will introduce a guide and comparison in case of tax penalties of some Southeast Asia countries, and the effort of tax amendment declaration that the taxpayer can do in order to reduce the penalties.

SINGAPORE

Companies are required to pay their tax within a month from the date of issue of the Notice of Assessment (NoA). 5% penalty will be imposed on unpaid tax after due date. If still did not make the payable after 1 month (60 days), additional penalty will be imposed 1%, but additional penalty cannot more than 12%. Therefore, the cap of total late payment penalty is 17%.

While, Inland Revenue Authority of Singapore (IRAS) introduced Voluntary Disclosure Programme (VDP) to encourage taxpayers make correction their tax error and reduce their tax penalties. VDP must be submitted before the IRAS issue any notification on commencement of tax audit. Once taxpayer submitted VDP, the tax payer MUST corporate fully with IRAS to correct the errors made, and pay or make arrangements with IRAS to pay additional taxes or amount exceeding cash payout than entitled to and penalties imposed.

| Type of Voluntary Disclosure | Penalty Treatment |

| Voluntary disclosure made within grace period of one year from statutory filing deadline |

No penalty imposed

|

| Voluntary disclosure made after grace period |

Reduced penalty of: · 5% of the income tax undercharged or of the amount of cash payout exceeding entitlement obtained, for each year the error was late in being rectified · Flat 5% of the GST undercharged · Flat 5% of the outstanding Withholding Tax |

| Voluntary disclosure made for late stamping or underpayment of Stamp Duty | Reduced penalty of 5% per annum computed on a daily basis on the Stamp Duty payable |

MALAYSIA

Malaysian companies are required to file their tax return after 7 months of their financial year end. While, there several penalties will be subject based on certain non-compliance of tax administration, as following:

| Offences | Penalties |

| Tax Payable is not paid within 30 days |

· A penalty of 10% will be added to the tax due · Further 5% of penalty imposed on unpaid tax if taxpayer still not settled within 60 days. |

| Failure to furnish Income Tax Return |

· RM 200 to RM20K · Imprisonment or both, OR · 300% of tax payable |

| Failure to furnish Income Tax Return for 2 YAs or more |

· RM1K to RM20K · Imprisonment or both, OR · 300% of tax payable |

| Make an incorrect tax return by omitting or understating any income, or incorrect information |

· RM1K to RM10K and 200% of tax undercharged, OR · 100% of tax undercharged |

| Wilfully and intentionally evade or assist any other person to evade | · RM1 to RM20K or imprisonment or both and 300% of tax undercharged |

| Late payment of tax liability under an assessment for a YA | · 10% of tax payable; additional 5% on any unpaid tax and penalty that is outstanding after 60 days |

| Late payment of tax instalment | · 10% of outstanding tax instalment amount |

Meanwhile, Inland Revenue Board of Malaysia (IRBM) had commenced Special Program for Voluntary Disclosure to encourage taxpayer to reporting correct tax and increase tax collection for country development by penalty reduction. While, the Special Program for Voluntary Disclosure will be valid from 3rd November 2018 to 30th Sep 2019. The following information of category and tax penalty reductions:

| Categories of Voluntary Disclosure | Period of Voluntary Disclosure and Rate of Penalty | |

| 3/11/2018 – 30/6/2019 | 1/7/2019 – 30/9/2019 | |

| Taxpayers who are not registered with IRBM and have not submitted tax assessment |

10% (payment to be made on or before 1/7/2019) |

15% (payment to be made on or before 1/10/2019) |

| Taxpayers who are registered with IRBM and have not submitted the tax assessment | ||

| Taxpayers who have submitted the tax but reported incorrect information. | ||

| Persons who present an instrument for stamping exceeding six (6) months from the stamping period (30 days from the date of the instrument’s execution) | 10% or a minimum of RM50 | 15% or a minimum of RM100 |

THAILAND

Thailand tax administration required companies prepare and files their tax return by the due dates and at the same time pays the taxes calculated to be due. The annual CIT return is due 150 days from the closing date of the accounting period. The following penalties would be applied when taxpayer fail to meet the required tax obligation:

| Offence | Penalties |

| Late Submission of Annual Tax Return |

· Late within 7 days: Fine 2000 baht · Late after 7 days: Fine 4000 baht |

| Late Submission for the Half Year Return |

· Late within 7 days: Fine 1000 baht · Late after 7 days: Fine 2000 baht |

| Failure of file tax return | · Penalty equal to twice the amount of tax due |

| A person consciously or intentionally fails to comply with summons or orders of Director-General of The Revenue Department |

· Imprisonment not exceeding 1 month, OR · Penalty not exceeding 2000 Baht, OR · Both |

| A person intentionally provides the false information in order to evade taxes |

· Imprisonment from 3 months to 7 years, AND · Penalty from 2000 Baht to 200,000 Baht |

| A person intentionally fails to file tax returns in order to evade or in an attempt to evade taxes |

· Fine of not exceeding 5,000 Baht, OR · Imprisonment for a term not exceeding 6 months, OR Both |

| A person does not comply summon or does not does not answer questions without justifiable reason after fail to file tax | · fine double the amount of tax payable. |

A taxpayer who is assessed additional tax by am assessment officer on the grounds that an inaccurate return was filed, or who failed to file a return, is subject to a penalty. The rate of penalty is 100% in the case of an inaccurate return and 200% for failure to file a return. Penalties may be reduced by 50% if the taxpayer submits a request in writing to the tax authorities to clarify that the taxpayer did not intend to evade tax and cooperated with officer during the tax audit. But voluntary filing must be done before any notice is issued by the Revenue Department. Once a Revenue officer issue any kind of notice, the reduced rates applying for voluntary filing are no longer available.

INDONESIA

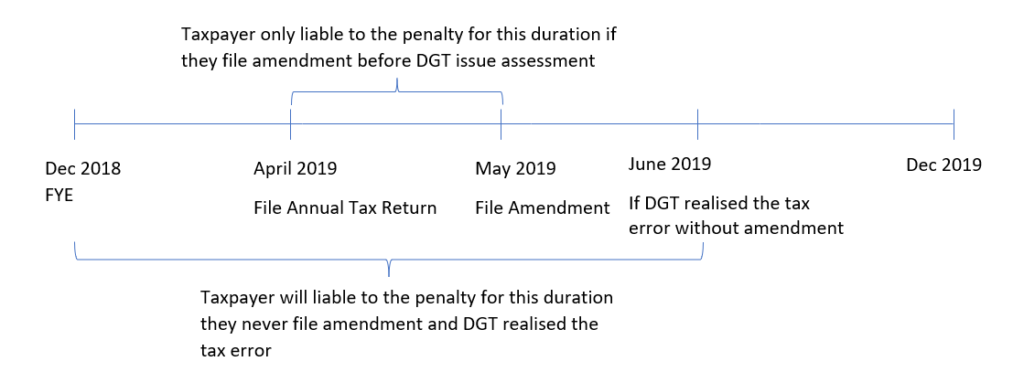

Under Indonesia taxation law, companies required to submitted their tax after 4 months of their financial year end. Penalty of 2% per months for maximum 24-months period will imposed, calculated from the end of date of relevant taxable period, if there is submitted tax error and make the tax payable amount higher than the tax paid. If there is any tax error made, taxpayer should file an amendment for the error before it finds out by the Directorate General of Taxes (DGT: Indonesian Tax Government). This is because the 2% of the penalty would only impose on the period between the date of annual tax return filed and the date of amendment filed. However, if the taxpayer never files an amendment, and the DGT found the tax error which makes more tax payable, the 2% penalty will be imposed from the relevant final year end to the date that DGT found the tax error.

PHILIPPINE

According to Philippine tax system, wilful neglect to file the return or intentionally file incorrect tax will be penaltised with 3 penalties: One Time Surcharge 25% or 50% of the basic tax, 20% annual interest on unpaid tax, and one-time compromise penalty.

Penalty surcharge of 25% applies on following:

(1) Failure to timely file any return and pay the tax due; or

(2) Filing Out-of-District Return or filing a return with an internal revenue officer other than those with whom the return is required to be filed; or

(3) Failure to pay the deficiency tax within the time prescribed for its payment in the notice of assessment; or

(4) Failure to pay the full or part of the amount of tax shown on any return required to be filed, or the full amount of tax due for which no return is required to be filed, on or before the date prescribed for its payment.

Penalty surcharge of 50% applies on following:

(1) In case of wilful neglect to timely file the return, or

(2) in case a False or fraudulent return is wilfully made

However, penalty surcharge would be reduced to 25% on addition tax, 20% interest on unpaid tax, and compromise penalty if taxpayer with amended return which contain additional taxes unaccounted for in their previous tax declarations. This would only apply when it has additional unpaid tax after the amendment.

VIETNAM

Based on Vietnam tax administration, companies need to pay their tax payment quarterly and file annual declaration within 90 days after the financial year end. A 20% penalty will be imposed on the amount of tax under-declared. Interest of 0.03% days applies for late payment of tax.

After the filing deadline, if the filed tax return content tax mistakes, taxpayers are allowed to submit amendment up to 10 years after the filing deadline, but it must be done before the tax authorities commence any tax audit. For tax period which have been audited, taxpayers are still allowed to submit amendment, but in such case penalties and interest will be applied as if the error had been discovered by the tax authorities during the tax audit. Tax penalties and late payment interest will be exempted if the taxpayer declare and pay taxes in accordance with rulings issued by the tax authorities at the time.

CAMBODIA

Under Cambodia tax administration, companies required to make a 1% of monthly turnover prepayment to CIT. The prepayment can be offset against the final tax returns. While, penalty will be applied on unpaid tax for failure to file, late filing or the filing of a fraudulent return. Taxpayer will subject to penalty of 10% of the underpaid tax due to negligent, 25% of penalty due to serious negligent, and 40% of penalty where taxpayer receives a unilateral tax assessment. Also, penalty interest of 2% would be applied per month on late and underpaid taxes.

Taxpayer may request to submit notification letter to amend a tax turn within 3 years of filing date of the tax declaration on the basis of an error or oversight made in original tax return. This notification letter presents as amendment for the tax return previously file and pay any additional tax due, without being charged penalties and interest. Also, taxpayer is allowed to request a re-assessment again after the outcome of the amendment assessment within 3 years and provide supporting documents.