COMPLIANCE REQUIREMENTS & BUSINESS STRUCTURES IN SG

1. Comparison of Difference Type of Business Structure in Singapore

| Sole proprietorship | General partnership | Limited Partnership (LP) | Limited Liability Partnership (LLP) | Company | |

|---|---|---|---|---|---|

| Owned By | 1 person | 2 – 20 partners | ≥ 2 partners, at least 1 General Partner (GP) and 1 Limited Partner (LP) | ≥ 2 partners | – Exempt Private Company: ≤ 20 members and no corporate shareholder. – Private Company: ≤ 50 members – Public Company: 1 – 50 members or more |

| Legal Limited Liability | No | No | GP – No; LP – Yes | Yes | Yes |

| Tax Liability | Taxed at owner’s personal tax rates | Taxed at partners’ personal tax rates | Taxed at partner’s personal tax rate (if individual); corporate tax rate (if corporation) | Taxed at partner’s personal tax rate (if individual); corporate tax rate (if corporation) | Taxed at corporate tax rates |

| Owning of Property | Can | Cannot | Cannot | Can | Can |

| Minimum Registration Requirements | Owner* must be Singapore citizen/ Singapore permanent resident/ EntrePass holder. If owner* not local resident, they must appoint an authorised representative who is local resident. | Owners* must be Singapore citizen/ Singapore permanent resident/ EntrePass holder. If owner* not local resident, they must appoint an authorised representative who is local resident. | Partners can be individuals* or body corporate (Company or LLP). If all general partners are ordinary resident outside Singapore, they must appoint local resident Manager* | 2 Partners can be individuals* or body corporate (Company or LLP) 1 local resident Manager* | 1 local resident Director* + 1 local resident secretary + 1 local/ foreign shareholder |

| Yearly statutory obligation | Yearly or 3 years renewal of Business Registration | Yearly or 3 years renewal of Business Registration | Yearly or 3 years renewal of Business Registration | Annual Declaration of Solvency or Insolvency | Annual Return filing |

2. How do I go about to register a Company / Business ?

3. What information and documents do I need to submit to register a Company / Business?

- 3 Proposed Company name;

- Business Activities;

- Share Capital details;

- How many shares

- $ per share

- Registered Office Address;

- Director(s)’s details:

- Name

- NRIC/ Passport

- Contact number

- Email address

- Shareholder(s)’s details:

- Name

- NRIC/ Passport

- Contact number

- Email address

- Number of shares and percentages of shareholding

- Financial Year End (FYE)

- 3 Proposed Business name;

- Business Activities;

- Registered Office Address

- Partner’s details:

- Individual

- Name

- NRIC/ Passport

- Contact number

- Email address

- Corporate

- Corporate Name

- Business/ Company’s registration number

- Corporate representative’s name, contact number and email address

- Individual

- Manager’s details

- Name

- NRIC/ Passport

- Contact number

- Email address

- 3 Proposed Business name;

- Business Activities;

- Registered Office Address;

- Owner’s details:

- Individual

- Name

- NRIC/ Passport

- Contact number

- Email address

- Corporate

- Corporate Name

- Business/ Company’s registration number

- Corporate representative’s name, contact number and email address

- Individual

- Authorised Representative details (if owner is not local resident)

- Name

- NRIC/ Passport

- Contact number

- Email address

- NRIC (front & back)

- NRIC (front & back)

- Passport bearing photograph, personal details and expiry date (please include address page, if any)

- Passport bearing photograph, personal details and expiry date (please include address page, if any)

- Work Pass (front & back) (e.g. employment pass/ S pass/ work permit/ dependent pass)

- Address proof not later than 3 months, bearing the name and residential address (i.e. bank statement/ utility bill)

- Passport bearing photograph, personal details and expiry date (please include address page, if any)

- National ID (front & back)

- Address proof not later than 3 months, bearing the name and residential address (i.e. bank statement/ utility bill)

- Clear certified copies of:

- Certificate of Incorporation

- Business Profile / Corporate Search / Certificate of Incumbency (or equivalent documents)

- Registers of Directors and Members

- Memorandum and Articles of Associations / Constitution / Bye-Laws (or equivalent documents)

- Group structure chart (for multi-tier company structure)

- Directors’ Resolutions or Power of Attorney authorising the signing of Constitution of the new Singapore company

Important Notes:

- All copies shall be certified by either notary public, lawyer or YTK personnel. The certifier is required to sign on the document(s)and state details of the certifier, i.e. full name, designation, company name/stamp and date of certification.

- YTK reserves the right to request for supporting documents and/or information in relation to the source of funds / wealth of the Ultimate Beneficial Owner(s) and/or shareholder(s).

4. What do I need to know about setting up a Company/ Business?

| Company Structure (minimum requirement) |

|

|||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Share Capital |

|

|||||||||||||||

| Yearly statutory obligation | Annual Return filing | |||||||||||||||

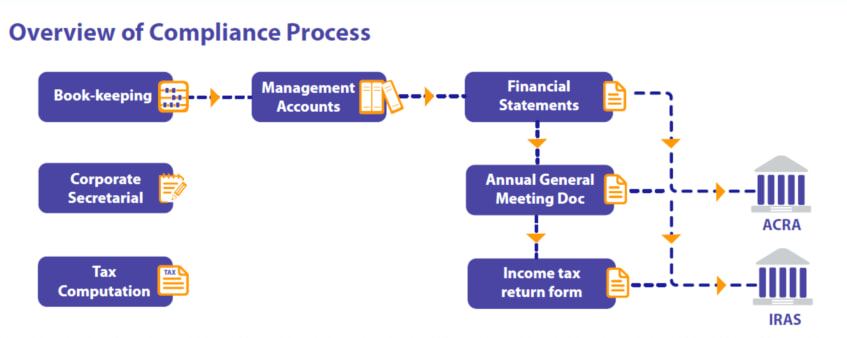

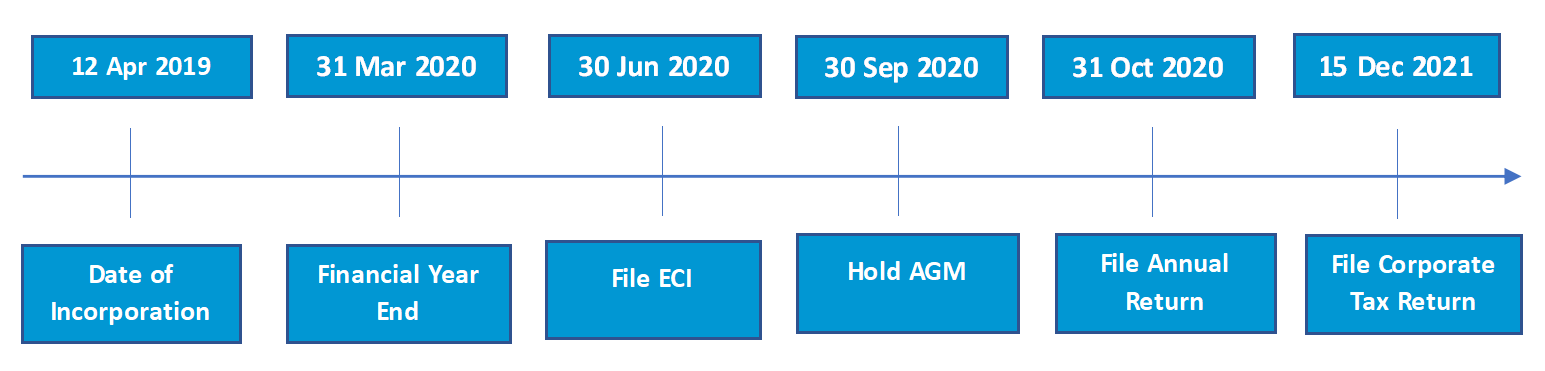

| Yearly Compliance Requirement and Deadline |

|

| Business Structure (minimum requirement) |

|

|---|---|

| Share Capital | N/A |

| Yearly statutory obligation | Annual Declaration of Solvency or Insolvency |

| Business Structure (minimum requirement) |

|

|---|---|

| Share Capital | N/A |

| Yearly statutory obligation | Yearly or 3 years renewal of Business Registration |

5. What are other compliances requirement in Singapore that I should know?

Rate

7%Compulsory Registration

- Your taxable revenue on past calendar year (from January to December) has exceed S$1 million, or

- If at any time, you can reasonably expect your taxable revenue in the next 12 months to be more than S$1 million.

Voluntary Registration

- Allowed

- Condition: Remain registered for at least two years.

Optional, IF

- Company meets at least 2 of following 3 criteria for immediate past two consecutive financial years: –

- Revenue < S$10m

- Assets < S$10m

- Worker <50

- If Company is part of a Group, the Group has meets at least 2 of the 3 of criteria above on a consolidated basis for the immediate past two consecutive financial years.

- Public Companies

- Private Companies

- Insolvent Exempt Private Companies (EPCs)

Rate

0% – 22%Rate

17%Tax Exemption Scheme (Effective tax rate is around 4.3% – 6.4%)

- 75 % of first chargeable income of S$100,000 is exempted from tax; and

- 50% of the next chargeable income of S$100,000 is exempted from tax

New start-up Company which meet following criteria can enjoy Tax Exemption Scheme for first 3 YAs:

- The Company is incorporated in Singapore;

- The Company is tax resident in Singapore for that YA; and

- At least one shareholder is an individual who holding at least 10% of the issued ordinary shares.

Except :- A company whose principal activity is that of investment holding; or

- A company which undertakes property development for sale, for investment, or for both investment and sale.

- All Employees

- Skills Development Levy (SDL) Employer must pay SDL for all employees working in Singapore. The SDL payable is at 0.25% of the monthly wage for each employee, with the minimum payable of $2 (for an employee earning less than $800 a month) and a maximum of $11.25 (for an employee earning more than $4,500 a month).

- Contributions to Self-Help Groups (SHGs)

Employees are required to make monthly contributions to these SHG funds, depending on their race or religion.

- The S Chinese Development Assistance Council (CDAC) Fund, administered by CDAC

Monthly Total Wages Monthly Contribution < $2,000 $0.50 > $2,000 to $3,500 $1.00 > $3,500 to $5,000 $1.50 > $5,000 to $7,500 $2.00 > $7,500 $3.00 - Eurasian Community Fund (ECF), administered by the Eurasian Association (EA)

Monthly Total Wages Monthly Contribution < $1,000 $2.00 > $1,000 to $1,500 $4.00 > $1,500 to $2,500 $6.00 > $2,500 to $4,000 $9.00 > $4,000 to $7,000 $12.00 > $7,000 to $10,000 $16.00 > $10,000 $20.00 - Mosque Building and Mendaki Fund (MBMF), administered by Majlis Ugama Islam Singapura (MUIS)

Monthly Total Wages Monthly Contribution < $1,000 $3.00 > $1,000 to $2,000 $4.50 > $2,000 to $3,000 $6.50 > $3,000 to $4,000 $15.00 > $4,000 to $6,000 $19.50 > $6,000 to $8,000 $22.00 > $8,000 to $10,000 $24.00 > $10,000 $26.00 - Singapore Indian Development Association (SINDA) Fund, administered by SINDA

Monthly Total Wages Monthly Contribution < $1,000 $1.00 > $1,000 to $1,500 $3.00 > $1,500 to $2,500 $5.00 > $2,500 to $4,500 $7.00 > $4,500 to $7,500 $9.00 > $7,500 to $10,000 $12.00 > $10,000 to $15,000 $18.00 > $15,000 $30.00

- The S Chinese Development Assistance Council (CDAC) Fund, administered by CDAC

- Workmen Compensation Insurance (WIC)

Employer is required to buy work injury compensation insurance for:

- All employees doing manual work, regardless of salary level.

- All employees doing non-manual work, earning ≤ $1,600

- Employers’ Responsibility to Report Employees’ Yearly Earnings Employers are required by law to prepare Employee Tax Form – Form IR8A and Appendix 8A, Appendix 8B or Form IR8S (where applicable) to all employees by 1 Mar every year. For Employer under Auto-Inclusion Scheme (AIS) for Employment Income, they must submit their employees’ income information to IRAS electronically by 1 Mar every year. The submitted information will be automatically included in the employees’ income tax assessment.

- Central Provident Fund (CPF) Contributions

Employers are required to make CPF contributions for their local employees at the monthly rates stated in the CPF Act. The employers must make payment on both the employer’s and employee’s share of the monthly CPF contribution. Employee shares of the contribution can be deducted from their wages. CPF contributions are due at the end of the month, with a grace period of 14 days.

Following is the contribution rates for Singapore Citizen and Singapore Permanent Resident (SPR) who obtaining SPR status from the third year and onwards:

You may refer to following link for the quick guide about CPF contributions rate https://www.cpf.gov.sg/Assets/employers/Documents/conrates_guide_2014.pdfEmployee’s age (Years) Contribution Rates for monthly wages ≥ $750 By Employer (% of wage) By Employee (% of wage) Total (% of wage) 55 and below 17 20 37 Above 55 and 60 13 13 26 Above 60 to 65 9 7.5 16.5 Above 65 7.5 5 12.5

- Foreign Worker LevyEmployer must pay Foreign Worker Levy at the prevailing rate to MOM monthly if they employ foreign employees who hold Work Permit or an S Pass.

- Tax Issues for Foreign Employees

-

- Employer must seek clearance for foreign employees leaving Singapore.

- Employer may deduct expenses relating to recruitment and relocation of foreign employees.

- The foreign employee will be regarded as a tax resident if he/she:

- Stay or work in Singapore

- for at least 183 days in a calendar year; or

- continuously for three consecutive years; or

- Are employed for at least 183 days for a continuous period over two years. This applies to foreign employees who entered Singapore but excludes directors of a company, public entertainers or professionals

- Stay or work in Singapore

- As a tax resident:

- He/she will be taxed on all income earned in Singapore.

- His/her income, after deduction of tax reliefs, will be taxed at progressive resident rates

- His/her foreign-sourced income (with the exception of those received through partnerships in Singapore) brought into Singapore is tax exempt.

- As a non-resident:

- He/she will be taxed on all income earned in Singapore.

- He/she will not be entitled to tax reliefs.

- His/her employment income will be taxed at a flat rate of 15% or the progressive resident rates, whichever results in a higher tax amount.

- Director’s fees and other income such as rent earned in or derived from Singapore will be taxed at the prevailing rate of 22%

-

FREQUENTLY ASKED QUESTIONS

Our turnaround time to incorporate a company is 1-2 working days upon receipt of all required information and documents. The name reservation and/or incorporation of a company usually will be approved by ACRA within a working day.

However, it may take between 14 days to 2 months if the application needs to be referred to other authorities for approval or review (e.g. depending on the Company name, business activities or has been referred to ACRA due to a random system check etc.)

In such cases, we will assist to expedite the application, subject to the approval of the relevant authorities.

Choosing the right type of business structure is a key decision when registering a business. The type of business structure will affect the financing, accounting, taxes, personal liability of directors, etc.

Choosing which type of business structure is depending on what aspects are you concern. We have list down some common type of key aspect that you may take into consideration when choosing the right business structure.

| Aspect | Sole Proprietorship | Company |

|---|---|---|

| Low Cost of Set Up | √ | |

| Low Cost of Retainer | √ | |

| Less compliance obligation to follow | √ | |

| Separate Legal Entity | √ | |

| Limited Liability | √ | |

| Tax Benefit | √ | |

| Easy to attract Investor | √ | |

| Easy to Expand Globally | √ | |

| Easy to Exit | √ |

Alternatively, you can also refer to the Comparison of Difference Type of Business Structure in Singapore from our website for your reference.

To open a corporate bank account in Singapore, you are required to submit Certified True Copies of IC/ Passport of all authorised signatories, directors, shareholders and all ultimate beneficiary owners to bank. Thus, opening of corporate bank account is relatively easy and fast for a Company which is owned by individual compare to Company which is under a group structure.

Estimated time taken to open a corporate bank account in Singapore is around 1 to 4 weeks depend on your company structure, nature of business and number of shareholder or corporate shareholder.

You can be a Director as long as you employ a local Director (i.e. Singapore Citizen, Singapore Permanent Resident or EntrePass holder) who meet the basic requirements below: –

- At least 18 years old;

- Of full legal capacity;

- Cannot be disqualified from acting as a director of a company (e.g. involved in any fraud or criminal activity, undischarged bankrupt etc.)

Singapore Companies Act allows 100% foreign shareholding, thus you can be a shareholder as well.

Individual who holding a work permit or S Pass can only be a minority shareholder (i.e. shareholding must be the lowest and cannot be more than other shareholders). Employment Pass holder can hold any percentage of shareholding in a Company.

You can be an employee for your Company under an Employment Agreements (also known as contract of service).

If you are a Singapore Citizen or Singapore Permanent Resident, you and your Company will be liable for CPF Contribution. Please ensure that your Company must have registered for a CPF Submission Number (CNS) before register you as an employee for CPF contribution.

On the other hand, if you are a foreigner, the Company must help you to submit for Employment Pass application to Ministry of Manpower (MOM). You can be an employee for your Company after the Employment Pass application has been approved by MOM.

Yes. You are entitled to receive Director Fee in your capacity as a company director, for the directorial services you have performed for the company even you are not an employee.

However, the payment of director fee is required to first be approved in a General Meeting by a Resolution unrelated to other matters under section 169 of the Companies Act.

It would depend if the director fee is received as a board director or as an executive director.

Director fee would generally be subjected to tax only if the Singapore Company is a Singapore tax resident. It does not depend on where the board meeting is held at or whether the director is not in Singapore for the calendar year.

If it is received as a board director, it would be subjected to a withholding tax of 22%. On the other hand, if it is received as an executive director, there is no need to withhold the tax. However, the Company should report the director’s income under the Auto-Inclusion Scheme (AIS).

An EP holder is allowed to own shares in a Singapore company.

EP holder is only allowed to work for the employer as specified on the EP. The EP holder can also be appointed to the Board of Directors of the same Company, without having to notify Ministry of Manpower (MOM).

However, Company appointing an EP holder from another Company to the Board of Directors must first seek approval from MOM. When the application is approved, the MOM will grant a Letter of Consent (LOC) to the EP holder to take up the secondary directorship.

MOM will generally grant a LOC only if:

- The Company is related by corporate shareholding (either direct or indirect) to the EP holder’s primary employer;

- Employment Pass holder is taking up the secondary directorship for purposes related to his/ her primary employment.

| FYE | First Accounting Period | YA | Basis Period |

|---|---|---|---|

| 31 December | 22 February 2020 – 31 December 2020 | 2021 (1st YA) | 22/2/2020 – 31/12/2020 |

| 2022 (2nd YA) | 1/1/2021 – 31/12/2021 | ||

| 2023 (3rd YA) | 1/1/2022 – 31/12/2022 | ||

| 31 January | 22 February 2020 – 31 January 2021 | 2022 (1st YA) | 22/2/2020 – 31/1/2021 |

| 2023 (2nd YA) | 1/2/2021 – 31/1/2022 | ||

| 2024 (3rd YA) | 1/2/2022 – 31/1/2023 | ||

| 30 April | 22 February 2020 – 30 April 2021 | 2021 (1st YA) | 22/2/2020 – 31/12/2020 |

| 2022 (2nd YA) | 1/1/2021 – 30/4/2021 | ||

| 2023 (3rd YA) | 1/5/2021 – 30/4/2022 |

- 1 Newly incorporated Company (number of shareholders ≤ 20 and at least one shareholder is an individual holding at least 10% of the issued ordinary shares), are qualified for Tax Exemption Scheme, except:

- 1. A company whose principal activity is that of investment holding;

- 2. A company which undertakes property development for sale, for investment, or for both investment and sale.

- 2 Year of Assessment is the year in which a Company’s income is assessed to tax.

- 3 Basis Period is a time period of each YA in which Company’s income is assessed to tax.

Yes, you can as long as you or your business has met the eligibility criteria and conditions as specified in Home Office Scheme.

Under the Home Office Scheme, homeowners are allowed to conduct small-scale registered businesses using their residential premises. This scheme applies to both HDB and private properties. You can summit the Home Office application before or after your business or company registration with ACRA.

For more information about Home Office Scheme, please click here