ESTIMATED CHARGEABLE INCOME (ECI)

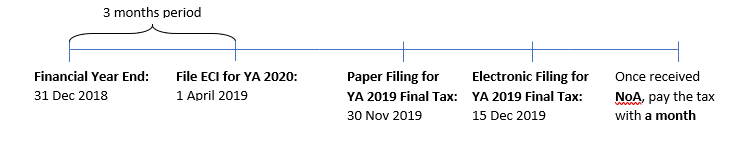

Individual or corporate who carrying trade on business are required to submit their ECI 3 months after its financial year end. It is the amount before deducting the partial tax exemption. The ECI must be submitted by e-filing and the payment could be paid by GIRO

One benefit of filing the ECI early is because of its instalment plan:

| ECI file within | Number of months of instalments allowed |

| 1 month from financial year end | 10 |

| 2 months from financial year end | 8 |

| 3 months from financial year end | 6 |

| ECI Submission by | 26th of each qualifying month |

Companies that fulfilled the following condition, will be exempted from filing ECI:

- Annual revenue less than 5 million, AND

- ECI to be nil

FINAL TAX RETURN

The statutory deadline to file the corporate tax for all companies is by 30 November of the following year. If the company choose to file via electronic means that the deadline to file is extended to 15 December.

If the final tax payable is more than the ECI been paid for the Year of Assessment (YA), the amount of difference between ECI and final tax is required to paid to IRAS. However, if the final tax is less than the ECI, the taxpayer will get the refund of the amount of the difference between ECI and final tax.

After filing the final tax return, a Notice of Assessment (NoA) will be issued by the CIT to the taxpayer. NoA is annual statement of tax bill

If taxpayer dispute the Assessment, the taxpayer is allowed to submit a notice of objection within 30 days from the date of service of notice of assessment. However, companies are still required make their tax payment, even if they are objecting the NoA. To allow company to have more time to prepare their objection, CIT would extend the deadline of the objection to 2 months if the taxpayer provide written request form within 2 months from the date of service of Notice of Assessment.

Notice of objection MUST include the following detail to be a valid objection:

(a) Year of Assessment

(b) Description of item(s) under objection

(c) Amount of income or deduction for each item under objection

(d) Reason explanation (e.g why deduction/ allowance/ relief ought to be allowed/ or the income should not be subject to tax)

The following flow chart is a summary for the deadline of tax administration:

PENALTY

For any person who carries on a trade or business are required to pay their tax within a month from the date of issue of the Notice of Assessment (NoA). And it despite any objection. If no paid by the due date, 5% penalty is imposed and a demand notice will be issued. If still did not make the payable after 1 month (60 days), additional penalty will be imposed 1%, but additional penalty cannot more than 12%. Therefore, the cap of total late payment penalty is 17%, which is the total percentage of penalty and additional penalties. Penalty also could be paid by instalments vis GIRO system in 12 months

The following table is a summary of the various penalties provided for under the ITA:

| Offences | Penalty |

| Non-compliance with provision of the ITA and no other penalty provided/ failure to make income tax return for 2 years or more |

· Penalty 200% of tax · Fine not more than $1K · Default of fine payment, maximum jail term of 6 months |

| Submit incorrect information | Penalty 100% of tax |

| Submit incorrect information without reasonable excuse | Penalty 200% of tax |

| Wilful intent to evade/ assist other evade tax |

· Penalty 300% of tax · Maximum jail term of 3 years |

| Serious fraudulent tax evasion |

· 400% of tax · Maximum jail term of 5 years · Maximum fine $50K |

RECORD KEEPING

Companies and individual are required to keep their supporting document records for 5 years in case of the tax queries raised by IRAS or tax amendment purposes. IRAS and the taxpayer has the right to raise queries and amendment with 4 years from end of Year of Assessment in which the assessment is made. Example of supporting documents for record keeping can be included: Invoices or receipt as proof of payment, bank statement, CPF statement, GST records, Rental agreement, Minutes of Annual General Meeting (AGM) and etc.